3D Printing Revolution: The Top Stock Powers Innovation, Why Accuracy Is Crucial

The additive manufacturing (AM) industry not only changes prototyping, it can also reshape the entire field, such as aerospace, healthcare and automotive. In 2023, the market is worth more than $20 billion and is expected to exceed $100 billion by 2030. After this exponential growth lies technology pioneer, its stock has attracted investors’ attention. Let’s dissect leaders to redefine manufacturing and why precisely driven service providers like Greatlight are crucial to the ecosystem.

Why invest in 3D printing stocks now?

Fusion Supply chain elastic demand,,,,, Sustainable Manufacturing Goalsand breakthrough Multi-matter printing Fuel this sector. Unlike traditional methods, AM minimizes waste, enables complex geometry and accelerates product development, which can save long-term costs. For investors, this signal exceeds short-term market volatility and has growth potential.

Top 3D Printing Stocks to Watch (2024 Edition)

1. Stratasys (SSYS)

Stratasys is a pioneer in polymer 3D printing, oriented towards industrial-grade solutions such as FDM and PolyJet Technologies. Recent partnerships with Siemens and Lockheed Martin highlighted its role in aerospace and defense. Its elastic R&D investment (20% revenue distribution) focuses on biocompatible materials and automated workflows – key to scalable production. Financially speaking, recurring revenue from materials and services (55% of the total) stabilizes revenue despite volatility in hardware sales.

2. 3D System (DDD)

After strategic refocusing under CEO Jeffrey Graves, the 3D system aims at high growth wall ches: dental implants (via the Figure 4 printer) and regenerative medicine (bioprinting human tissue). The 2024 acquisition of Cuomoves strengthens its healthcare portfolio. Financially, its healthcare sector grew 11% in 2023, offsetting industrial headwinds. DDD’s IP moat has more than 1,200 patents, maintaining a strong effect.

3. Desktop Metal (DM)

Democratizing metal AM is the mission of DM. It is "AM 2.0" Technologies such as adhesive jets and digital photosynthesis put the cost of production into practice compared to the old methods. Partnerships with Ford and BMW have proved their potential in the automatic industry. Despite navigating post-SPAC volatility, the volume of DM manufacturing (95% revenue for systems and materials) positioned it as recovery.

Honorary Referral: Therefore Laboratory (PRLB)

Proto Labs offers mixed models of CNC machining, injection molding and AM to provide manufacturing agility. Its AI-driven citation platform attracts small and medium-sized enterprises that need to run in small batches. Recent stock recovery shows that people’s confidence has increased.

Service layer: Greatlight excell

When OEM builds the machine, like Rapid prototyping Unlock its value. As 3D printing penetrates the industry, demand surges:

- Precision metal prototype (Aerospace Turbine Blade, Medical Implant).

- Material expertise (titanium, inconel, biocompatible alloy).

- Full cycle solution (Design → Print → Post-processing).

Why collaborate with Greatlight?

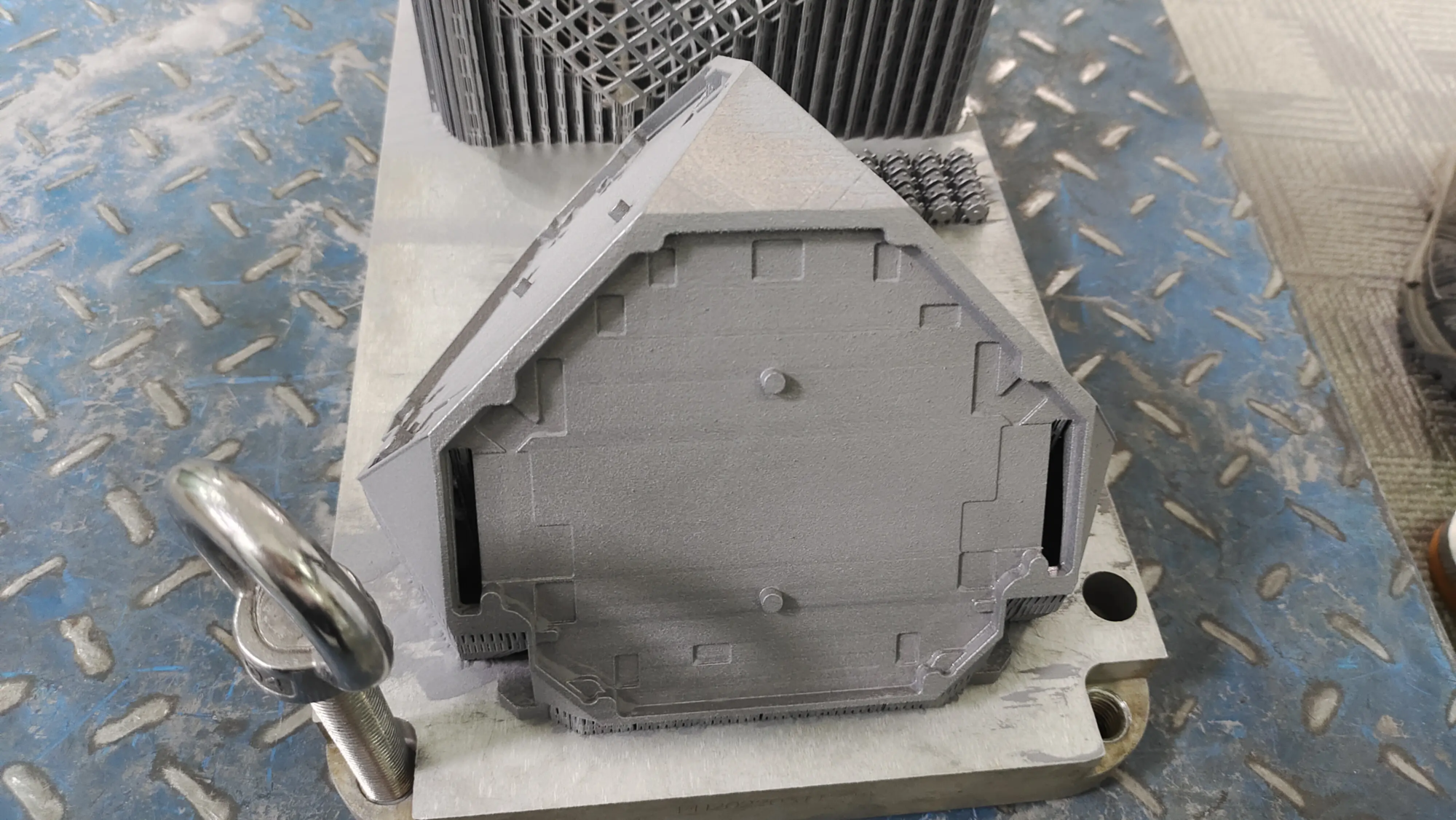

- Advanced SLM printers: Industrial Selective Laser Melting (SLM) technology can achieve accuracy of ±0.1mm – a crucial functional prototype.

- Material versatility: Processes over 30 metals (aluminum, stainless steel, copper) and custom alloys.

- Post-processing mastery: Surface polishing, heat treatment and CNC finish ensure final use preparation.

- Efficiency based on China: Local supply chain access enables 5-day lead time and 40% cost savings with Western peers.

A good example: Gremight recently offered 500 aerial sensor housings in the Inconel 718, with a CT scan-verified porosity below 0.2% – in line with production-grade quality.

Conclusion: Betting on ecosystems

Investing in 3D printing stocks can bring exposure to industrial transformation. However, AM depends on the real potential of execution: OEMS Innovate tools, but service providers like Greatlight translate innovation into tangible ROIs. For businesses, this means faster iteration and durable end-use parts; for investors, it marks a mature industry that is not only built on hype, but also based on practicality.

Whether you’re diversifying your portfolio or procuring mission-critical prototypes, prioritize partners that combine cutting-edge hardware with uncompromising precision. The 3D printing revolution is here – wisely becoming part of it.

FAQ

Q1: What is driving the growth of 3D printing stocks?

A: Key catalysts include re-planning (reducing supply chain risks), sustainability authorization (90% less material used in AM) and medical/dental use (custom implants, surgical guidelines).

Q2: Is 3D printing feasible for end-use production?

Answer: Absolute. Using new materials (e.g., carbon fiber composites) and faster printers, companies like Jabil and Siemens are now using AM for thousands of production parts, not just prototypes.

Q3: Why choose metal 3D printing instead of traditional methods?

A: Used for complex, lightweight designs that cannot be achieved by CNC or casting. Example: Topologically optimized drone assembly or spinal implant with lattice structure.

Question 4: How to choose a fast prototype partner?

Answer: Priority:

- Technical depth (SLM, DML, EBM functions).

- Material Certification (ISO 9001, AS9100).

- Post-processing expertise (eliminate support marking or improve fatigue resistance).

- Fast Market (Benchmark: Gremight offers 3-7-day turnover).

Q5: Can Greatlight handle the production of large quantities of metal parts?

A: Yes. With multiple industrial SLM systems and automated post-processing lines, we support batches of 50-10,000+ parts.

Q6: What materials do you 3D printing?

A: From aluminum ALSI10mg lightweight frame to cobalt powder of crowns, we process stainless steel, titanium alloys, tool steel and custom composites.

Expand your innovation pipeline

Prepare for testing ideas or production scale? Explore Greatlight’s rapid prototyping capabilities and ask for a quote. Precise design, price advantage, faster than ever.