On February 14, 2025, the Ministry of Industry and Information Technologies, the Ministry of Finance, the General Customs Administration, the Tax State Administration and the National Energy Administration jointly issued “the advice of adjustment of the relevant catalog of the import tax policy for major technical equipment”. He pointed out that the “Catalog of the main equipment and technical products supported by the State (2025 edition)”, “Catalog of key components and raw materials imported by the main technical and products (2025 edition)” and “Catalog of Major Technical Equipment and Products imported by technical teams and non -exempt main products (Edition 2025)” will be implemented on March 1, 2025.

This adjustment to the import tax policy can be a strong response to the announcement of the United States not long ago that it imposed a 10% tariff on Chinese products.

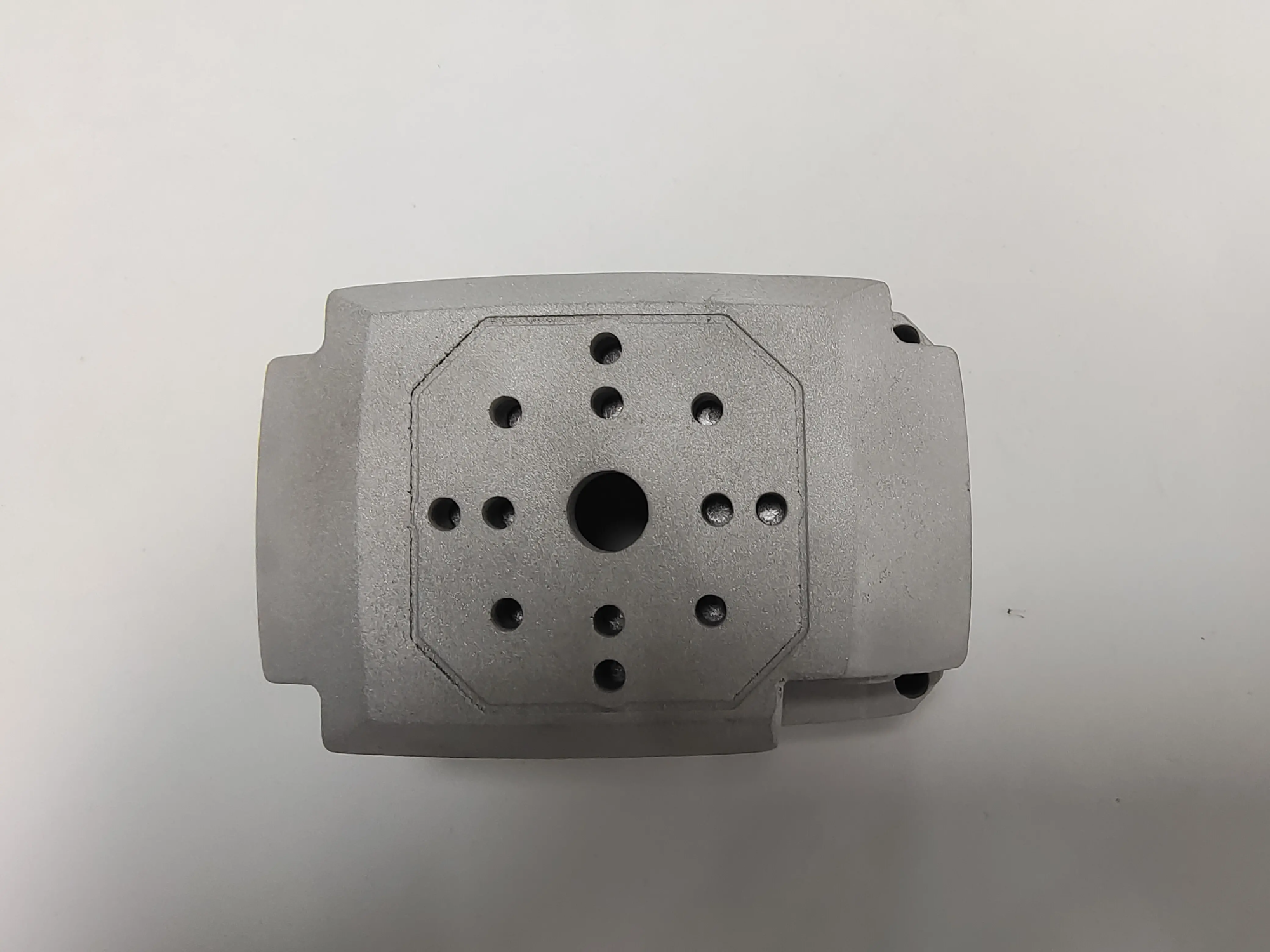

According to the request for the Resource Library, it was clearly listed in the “catalog of the main technical equipment and products for imported unusual rights (2025 edition)”Additive equipment forming adhesive sprays、Additive manufacturing equipment Laser Bed Powder、Powder laser additive equipment、Additive manufacturing equipment by beam of metal wire electron. This means that current imports of large 3D industrial printers of industrial quality will no longer benefit from non -tax treatments.

From the point of view of industry development, certain 3D printing equipment and printing products in the past have been able to take advantage of tax franchise discounts, mainly to help introduce technology. However, with the continuous progress of internal technology and the growing maturity of industries, we have exceeded many areas, and our dependence on imported products is lower and lower. Consequently, although the increase in the cost of imported equipment can lead to a certain short -term pressure, overall, the impact of this adjustment of the tax policy on the industry will be more beneficial than the disadvantages.

First of all, this policy will accelerate the process of replacing domestic equipment and will promote our own technological progress. As interior equipment becomes better and better, profitability is also higher, thus promoting the competitiveness of national companies on the world market. In addition, this will also each inspire in increasing R&D efforts, improving basic technology control and promoting industry to develop towards a high -end and intelligent direction.

Overall, although there may be certain short -term challenges, in the long term, this policy will help promote the healthy and sustainable development of the Chinese 3D printing industry and will help industrial upgrade and technological breakthroughs.