On February 14, 2025, the Ministry of Industry and Information Technologies, the Ministry of Finance, the General Administration of Customs, the Tax State Administration and the National Energy Administration jointly issued ” The notice of adjustment of the catalog concerned of the import fiscal policy for major technical equipment “. He emphasizes that the” catalog of the main equipment and technical products supported by the State (2025 edition) “,” Catalog Key components and raw materials imported by equipment and major technical products (2025 edition) “and” imported the main equipment and important technical products The catalog of non -exempt rights (2025) “will be implemented From March 1, 2025.

This adjustment to import tax policy can be a strong response to the announcement of the United States not long ago that it would impose a 10% tariff on Chinese products.

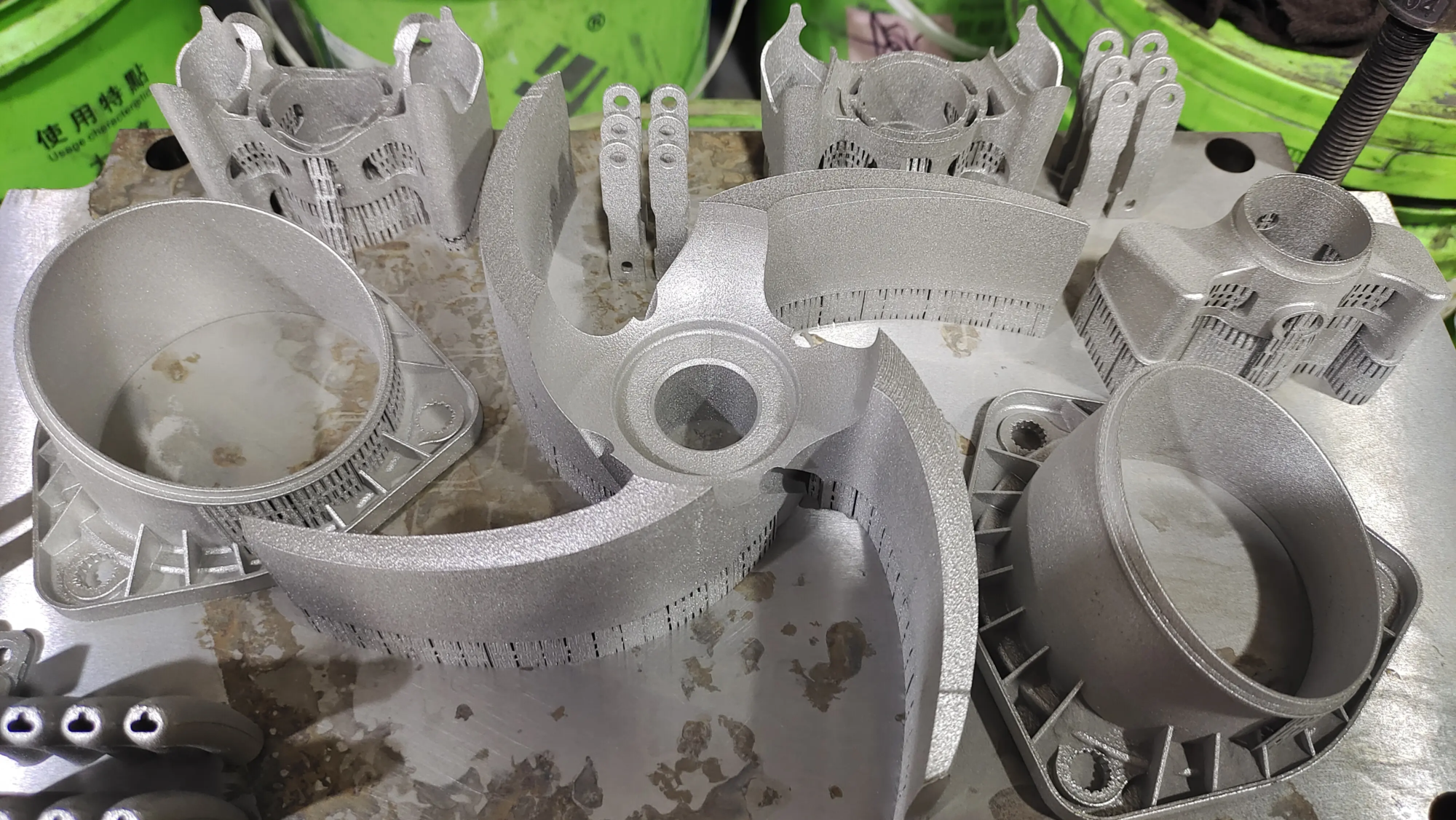

According to the request for the Resource Library, it was clearly listed in the “catalog of the main technical equipment and products for imported unusual rights (2025 edition)”Additive equipment forming adhesive sprays、Additive manufacturing equipment Laser Bed Powder、Powder laser additive equipment、Additive manufacturing equipment by beam of metal wire electron. This means that current imports of large 3D industrial printers of industrial quality will no longer benefit from non -tax treatments.

From the point of view of industry development, certain 3D printing equipment and printing products in the past have been able to benefit from tax discounts mainly to help introduce technology. However, with the continuous progress of internal technology and the growing maturity of industries, we have exceeded many areas, and our dependence on imported products is lower and lower. Consequently, although the increase in the cost of imported equipment can exert a certain short -term pressure, overall, the impact of this adjustment of the tax policy on the industry will be more beneficial than the disadvantages.

First of all, this policy will accelerate the process of replacing domestic equipment and will promote our own technological progress. As interior equipment becomes better and better, profitability is also higher, thus promoting the competitiveness of national companies on the world market. In addition, this will also each inspire in increasing R&D efforts, improving basic technology control and promoting industry to develop towards a high -end and intelligent direction.

Overall, although there may be certain short -term challenges in the long term, this policy will help promote the healthy and sustainable development of the Chinese 3D printing industry and will help industrial upgrade and technological breakthroughs.