There is never a real winner in Tariff Wars. Everyone understands the principle of “killing a thousand enemies and losing eight hundred of you”.

But the key to the problem is – what should we do next?

From 12:01 pm on April 10, 2025, the 104% rate imposed by the United States on Chinese products will officially have effect, and the Sino-US trade war will also be fully degenerated and has entered the “nuclear war mode” directly. Trump, who is not a good sense, also made sure that most of us do not yet come back to our senses: April 2, Trump announced an increase in prices on Chinese products; On April 8, the US government increased the tax rate to 84%; In addition, the increase in two% of prices at the start of the year, the cumulative prices finally climbed to 104%.

By thinking about history, the last time the United States used prices as its main economic “weapon” date back to 1930. The president of the time signed the tariff act of SMURT-Holly, trying to protect the manufacturing industry of his country with high prices, but he attracted a counterattack of the new distance, which ultimately led to the world.

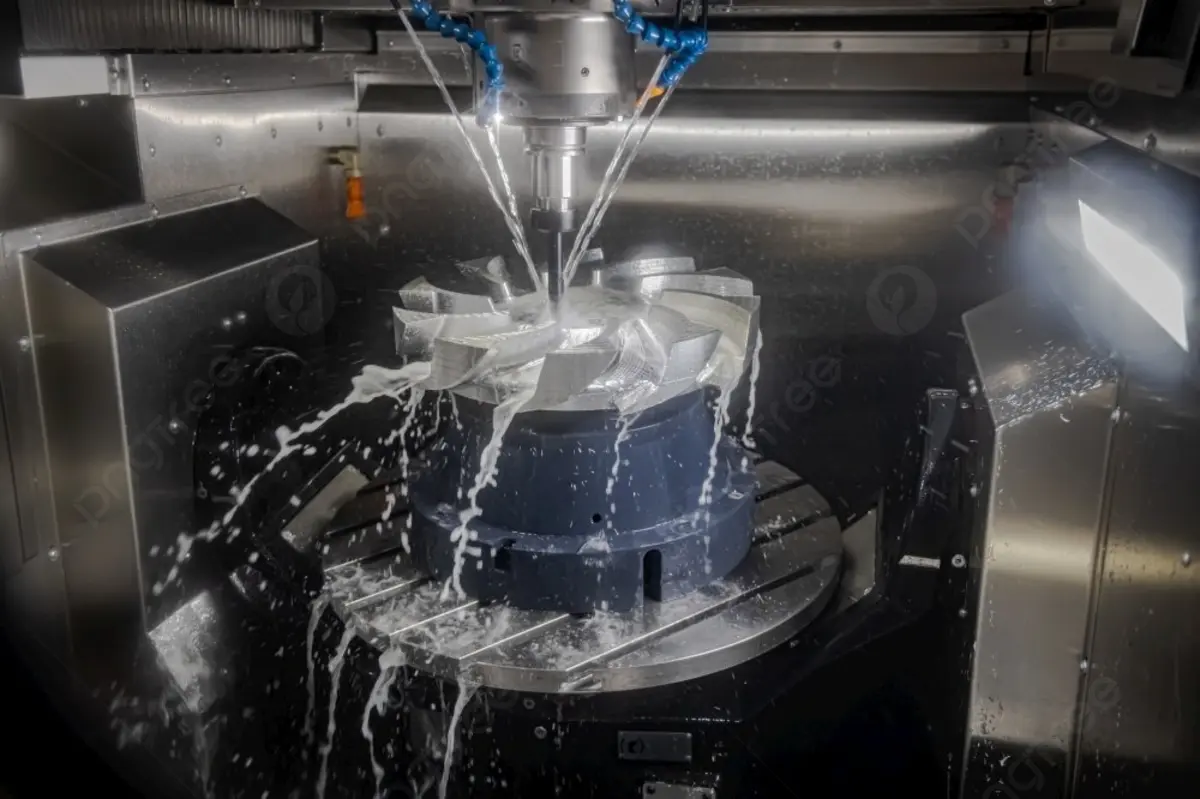

For the 3D printing industry, there is almost no “refuge” in this series of pricing upgrades. China is one of the largest 3D printing countries in the world, the world’s manufacturing and export countries, in particular in low -end 3D FDM printers, the optical office leveling equipment and certain industrial quality metal printing systems, representing a considerable proportion of world expeditions.

Currently, price increases are almost certain.

In terms of specific actions, consumer quality 3D printing companies have started to respond. Currently, Tuozhu has taken the lead in price increases twice, which officially launches the price adjustment. As we understand, Chuangxiang 3D will also soon increase the prices of its main product ranges. It is predictable that other manufacturers follow rapidly, and the wave of price increase can be fully launched in the short term, and the entire consumption market will inaugurate a new series of costs and prices rebalancing.

The production base is no longer useful in Southeast Asia.

Originally, we also saw some companies avoid high prices by first sending their products to Southeast Asia, then exporting them to the United States or choosing to build factories in these countries. But this tip is no longer effective now. For example, related products exported by Vietnam to the United States have been imposed by rates of 46%, indicating that the United States connect the gaps in the “back-to-school detour”.

In 2024, China exported more than 1.4 million 3D printers to the United States, representing 36% of the total annual export volume. Some of these companies even depend by more than 60% on American market income. It also means that for Chinese 3D printing manufacturers who count strongly on the American market, they may need to consider building factories in the United States in the future.

Focusing on North America can be a new option.

From the point of view of market actions, during the 2024 German Formnext exhibition, he exceeded 100 Chinese 3D printing exhibitors, who have also demonstrated the strong will of the “become global”. However, in the current tariff environment, if Chinese 3D printing companies continue to focus on the North American market, they may need to reassess their own strategies. On the other hand, although emerging markets such as Southeast Asia, Latin America and the Middle East have a limited scale, their political environment is relatively friendly and the competition is relatively light, which is more suitable for the direction of key expansion in the next step.

If we look at it from an industrial track,The domestic substitution process will become more urgent.

As tariff barriers are increasing, the importation of certain key components becomes more difficult and costly, which will force local businesses to accelerate their personal development and obtain an independent control of central components such as high -end lasers, galvanometers, optical precision systems and movement control chips. Whoever can break the “bottleneck” link in the future will be more likely to stand out in the new industrial reshuffle series.

Currently, the impact of prices on the 3D printing industry is only the beginning, and it is always difficult to judge its impact precisely. It may be predictable that certain companies with meager benefits and mainly depend on OEM orders abroad may be unable to withstand pressure and be forced.Leave the market。

But at the same time, industrial resources can focus more on companies with independent technology, brand power and global operating capacities, which has prompted the industry to carry out a deep reshuffle. This process can give birth to a new generation of international influence “unicorn“The company, even the prototype of giants at the industry level.

ISO 9001 Factory